Saving money and helping the planet is now simple. Ebike rebates and tax credits in 2025 make it easy. The E-BIKE Act gives a 30% tax credit. You can get up to $1,500 back on your bike. States like Colorado and Vermont offer more rebates. These range from $500 to $5,000, depending on income. Electric bikes save money, costing about $5 a month to charge. They also cut carbon pollution by over 90% compared to cars.

Key Takeaways

-

The E-BIKE Act gives a 30% tax credit for e-bikes. You can save up to $1,500 on your purchase.

-

Some states offer extra rebates from $250 to $5,000. These depend on your income and where you live.

-

E-bikes are cheaper to use, costing about $5 a month to charge. They also cut down pollution compared to cars.

-

To save more, use both federal tax credits and state rebates. This helps you get bigger discounts on your e-bike.

-

Keep track of rebate changes and organize your purchase papers. This makes applying for savings easier.

Federal Ebike Rebates and Tax Credits

Overview of the E-BIKE Act

The E-BIKE Act stands for Electric Bicycle Incentive Kickstart for the Environment Act. It helps make e-bikes cheaper for Americans to buy. This program gives a 30% tax credit when you buy an e-bike. The most you can get back is $1,500. To qualify, the e-bike must cost under $8,000. You can claim this credit once every three years. If you file taxes with a partner, you can claim it twice in three years.

The goal is to make e-bikes a good car alternative. This helps cut pollution and makes transportation fairer for everyone. The IRS will check how the credit is used by income levels after two years. This ensures the program stays fair for all income groups. By helping people buy e-bikes, the act fights climate change and improves transportation options.

How the federal ebike tax credit works

Getting the federal ebike tax credit is easy. Buy a qualifying e-bike and apply for the credit during tax time. The credit lowers the federal taxes you owe, saving you money. For example, if your e-bike costs $4,000, you could get $1,200 back (30% of the price).

This credit is only for new e-bikes that meet certain rules. The bike’s motor must be less than 750 watts. There are also income limits to make sure lower-income people benefit most. By using this program, you save money and help the environment at the same time.

Benefits of federal incentives for electric bike buyers

Federal programs like the E-BIKE Act make e-bikes cheaper and easier to buy. These incentives lower the upfront cost, so more people can afford them. E-bikes cost less to maintain and charge compared to cars.

E-bikes also reduce traffic and make city air cleaner. Using these federal incentives saves you money and helps the planet. Programs like this show how government actions can make eco-friendly travel possible for more people.

State-Specific Ebike Rebates and Programs

California ebike tax credit and rebate programs

California is helping people afford e-bikes with great programs. The California electric bicycle rebate gives up to $2,000 to those with lower incomes. If your income is 300% or less of the federal poverty level, you can qualify. People earning under 225% or living in struggling areas get $250 more. These rebates aim to help more people, especially in underserved places, buy e-bikes.

The California ebike tax credit adds even more savings. It lowers the taxes you owe when you buy an e-bike. By using both rebates and tax credits, you can pay much less upfront for an e-bike. California’s programs encourage eco-friendly travel, reduce traffic, and clean the air.

Colorado and other state-level electric bike incentives

Colorado has a simple state-specific electric bike incentive. You can get $400 back for buying an e-bike or $500 for a cargo e-bike. To qualify, you must purchase your bike from a local shop. This program supports local businesses and promotes green transportation.

Other states also offer helpful programs. For example:

-

Minnesota: Rebates cover 50–75% of e-bike costs, up to $1,500.

-

Texas: Residents in certain air quality zones can get $500 rebates.

-

Washington, D.C.: Low-income buyers of cargo e-bikes can get up to $2,000.

These programs show how states are creating plans to fit local needs. Whether it’s a rebate, tax credit, or voucher, these programs make e-bikes cheaper and easier to own.

Summary table of state ebike rebates for 2025

Here’s a quick look at ebike rebates and tax credits available in 2025:

|

State |

Incentive Type |

Benefit Details |

Eligibility Criteria |

|---|---|---|---|

|

Arizona |

Rebate |

Up to $300 rebate on e-bike purchases |

All residents |

|

California |

Rebate |

Up to $2,000 rebate for income-qualified residents, plus $250 for disadvantaged communities |

Residents aged 18+ with household income ≤ 300% of federal poverty level |

|

Colorado |

Rebate |

$400 rebate for e-bike purchases, $500 for cargo e-bikes |

Residents purchasing from local stores |

|

Connecticut |

Rebate |

$250 rebate for e-bike purchases, up to $500 for low-income families |

All residents, additional benefits for low-income families |

|

Florida |

Tax Exemption |

No sales tax on e-bike purchases |

All residents |

|

Minnesota |

Rebate |

$350 rebate for e-bike purchases, additional funds for low-income individuals |

All residents, with additional support for low-income |

|

Texas |

Rebate |

$250 rebate on new e-bike purchases |

All residents |

|

Washington, D.C. |

Voucher |

Up to $2,000 for low-income residents purchasing cargo e-bikes |

Low-income residents |

These programs show growing support for e-bikes across the U.S. No matter where you live, you can save money and help the planet by using these incentives.

Eligibility for Ebike Rebates and Tax Credits

Income rules for federal and state programs

Your income decides if you can get ebike rebates. Many programs focus on helping families with lower incomes. Federal programs set income limits based on family size. For example, a family of four qualifies if they earn under $93,600. Families making less than $46,800 may get extra benefits.

|

Family Size |

Max. Income for Rebate |

Max. Income for Extra Rebate |

|---|---|---|

|

1 |

$45,180 |

$22,590 |

|

2 |

$61,320 |

$30,000 |

|

3 |

$77,460 |

$38,730 |

|

4 |

$93,600 |

$46,800 |

|

5 |

$109,740 |

$54,870 |

|

6 |

$125,880 |

$62,940 |

|

7 |

$142,020 |

$71,010 |

|

8 |

$158,160 |

$79,080 |

States also have income rules. For example, Minnesota gives up to $1,500 to low-income families. Washington, D.C., offers $2,000 for cargo e-bikes. These programs make e-bikes cheaper for people who need them most.

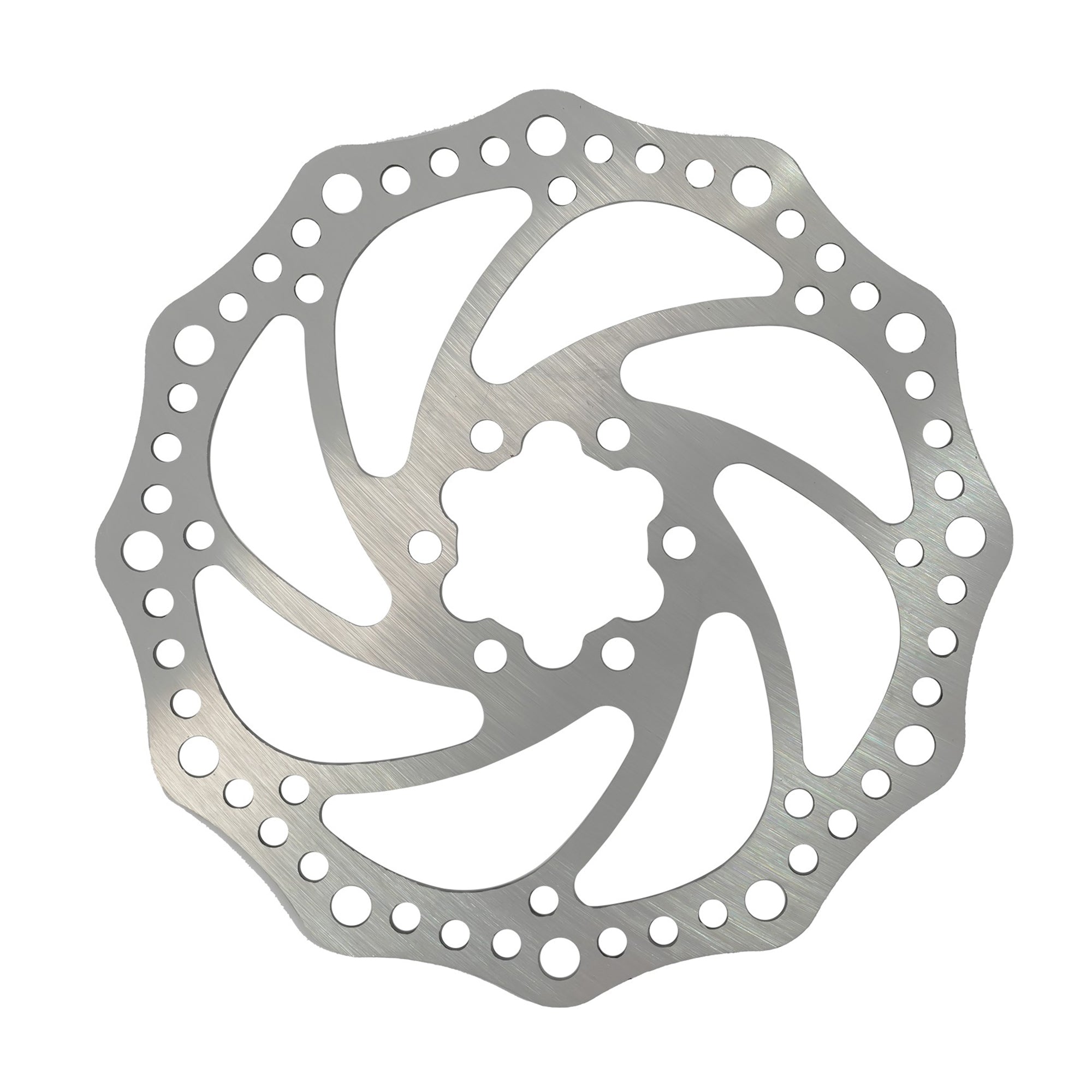

Rules for eligible e-bikes

Not all e-bikes qualify for rebates or credits. Your e-bike must meet safety and technical rules. For example, the motor must be under 750 watts. The bike cannot go faster than 20 mph using the motor. It must also have working pedals and meet UL 2849 safety standards.

|

Standard |

What It Ensures |

|---|---|

|

UL 2271 |

Keeps batteries safe for light electric vehicles. |

|

UL 2849 |

Makes sure e-bike electrical systems are safe and follow rules. |

|

UL 2272 |

Covers safety for personal mobility devices like powered bicycles. |

|

CPSC Definition |

Limits motor power to 750 watts and speed to 20 mph for eligibility. |

You must buy your e-bike from an approved store. The bike’s price must also be under $8,000 for federal programs. These rules ensure only safe and reliable bikes qualify.

Other important rules to know

Other factors may affect your rebate eligibility. Some programs require you to be 18 or older. Rebates may only apply to certain e-bike types, like Class 1, 2, or 3 models. You must also buy a new e-bike, not a used one.

Here are more rules to check:

-

The e-bike must have working pedals.

-

It must meet UL 2849 safety standards.

-

You must buy it from an approved store.

-

The price cannot be over $8,000.

These rules make sure rebates support safe and eco-friendly transportation. Follow these steps to get the most out of rebates and tax credits.

How to Apply for Ebike Rebates and Tax Credits

Steps to apply for the federal ebike tax credit

Getting the federal ebike tax credit is simple. Follow these steps:

-

Submit your tax return or application: Include proof of purchase and eligibility details.

-

Check deadlines and rules: Make sure you meet all requirements and submit on time.

-

Ask for help if needed: Contact the IRS or check official resources for guidance.

The process is designed to be easy. You’ll need your e-bike receipt and proof it meets the program’s rules. Always check government websites for updates to avoid mistakes.

How to apply for state ebike rebates

State ebike rebates differ, but they all aim to help residents afford e-bikes. Here’s a quick guide for some states:

Each state has its own rules. Visit your state’s website for exact instructions. For example, Californians apply through CARB, while Minnesotans contact their Department of Revenue. Watch deadlines and requirements to get the most savings.

Documents you need to apply

Having the right documents makes applying easier. Here’s what you’ll need:

-

Make sure your bike meets motor and safety standards.

-

For federal tax credits, include the correct form with your tax return.

-

State rebates may need proof of income and where you live.

Being organized helps avoid delays. Confirm your e-bike qualifies and double-check what documents are required for your rebate or tax credit.

Tips to Save More on Electric Bikes

Using both federal and state rebates together

You can save more by combining federal and state programs. First, check if your e-bike qualifies for the federal tax credit. This credit gives back 30% of the bike’s price, up to $1,500. Then, look into your state’s rebate options. States like California offer $2,000 for income-qualified buyers. Colorado gives $400 to all residents.

For example, buying a $4,000 e-bike in California could save you $3,200. You’d get $1,200 from the federal credit and $2,000 from the state rebate. Follow the rules, like income limits and bike price caps, to qualify. Combining these programs lowers your bike’s cost a lot.

Staying updated on new rebates and programs

Ebike rebates and tax credits change often. Stay informed to catch new deals. Sign up for newsletters from groups like the League of American Bicyclists. Your state’s transportation department also shares updates.

Check local government websites or social media for news. Some programs are only available for a short time. For example, Washington, D.C., recently started a voucher program for low-income buyers. Staying updated helps you grab every chance to save.

Keeping important documents organized

Keeping good records is key for rebates and tax credits. Save your e-bike receipt and proof it meets safety rules. Federal programs need the right tax form with your return. State rebates may ask for proof of income or where you live.

Make a folder to store all your papers in one spot. Digital copies are useful if you lose originals. Being organized makes applying easier and avoids delays in getting your money back.

Ebike rebates and tax credits in 2025 make e-bikes cheaper. These programs lower bike costs and support green transportation. Using these incentives saves you money and helps the planet. Check out rebates and tax credits now. Whether it’s your first e-bike or an upgrade, these programs help you save while supporting a cleaner future.

FAQ

What’s the difference between a rebate and a tax credit?

A rebate gives money back after buying an e-bike. A tax credit lowers the taxes you owe when filing. Both help make your e-bike cheaper.

Can I use both federal and state incentives?

Yes, you can combine federal tax credits with state rebates. Check each program’s rules to save the most on your e-bike.

Do all e-bikes qualify for these programs?

No, only some e-bikes qualify. The motor must be under 750 watts. The bike must also meet safety rules like UL 2849. Always check before buying.

How do I show my e-bike qualifies?

Keep your receipt and check the bike meets safety rules. Some programs may also need proof of income or where you live.

Are there income limits for these programs?

Yes, many programs have income limits. Federal credits focus on lower-income families. State rebates have different rules, so check your area’s details.

Ebike Locks

Ebike Locks

Phone Mount

Phone Mount

Payment

Payment Afterpay Financing

Afterpay Financing Warranty

Warranty Shipping Policy

Shipping Policy Exclusive Discounts

Exclusive Discounts Track Your Order

Track Your Order Return & Refund

Return & Refund Referrals & Membership

Referrals & Membership User Manual

User Manual Contact Us

Contact Us FAQs

FAQs